For sake of entertainment, let's check my recent forecast, and let's see how former week's guess worked:

http://smartmoneyvolume.blogspot.com/2010/08/week-end-summary_22.html

As we can see, the bearish scenario came into play.

My 60 min tuesday forecasted a possible trend support and change around 1040. As per moment that support worked, marked GAP magneted market upwards. We need to monitor whether this support capable to stabilize the market.

http://smartmoneyvolume.blogspot.com/2010/08/no-selling-volume-exhaustion.html

Market status:

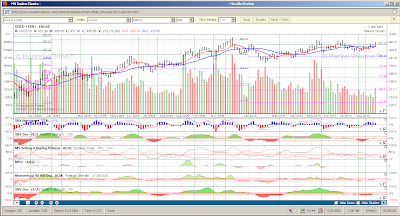

SPX500 2 days:

SBV histogram eased 1%, still in negative territory. SBV oscillator does not show exhaustion, further bullish accumulation needed to give trend change signal. MV SB volume indicates 1% ease on selling volume, buying volume remains flat. Volume momentum oscillator rose (from minus 47) above critical level (minus 18) and targets upward area. This dramatic change suggests high probability trend-change.

Recent week's selling volume and liquidity pull-out made pretty large damage on market internals, last friday's rally resulted minor effect in long-term indicators, further bullish volume insertion needed to eliminate selling volumes and rise flat buy volume index from steady zero.

SPX500 1 day:

SBV histogram shows slow elimination of current selling wave, however far from a trend-change confimration line-cross event. SBV oscillator reached it's maximum and gave up 1% from -54 to -53. More bullish volume need to be inserted in order to reach -33 bull signal.

MVO oscillator exhausted. It means current selling wave finished it's most intensive part. Momentum AD volume oscillator (-30%) gained 10% and rose to touch the signal line to -20%. Volume based sentiment indicator rose 7 points to 37. Reaching 43 usually means possible sentiment change gives throttle to bull side.

SPX500 60 min:

I made detailed analysis in my recent post. All indicators suggest temporary rise will result further growth then overheated momentary market situation leads to few days slowdown in near-term (1-2 trading days)

GOLD miners 3day

As precious metals are small volume and volatile, 1,2 days analysis did not take place.

Four indicators of five give confirmed bull in play. Momentum fell to zero suggests minor correction then further, safe rise in prices.

Summary:

SPX500:

Most probable scenario is bullish. Market status is not safe. Weak internals and non-exhausting selling power suggest re-test of 1040 area, giving place to further buy volume entry on lower levels, then trend change upwards result clear bull conditions. Liquidaton, danger and safe zones marked below.

60 min spx

1day spx

GOLD miners, silver:

Gold started its rally and shows huge bullish volume accumulation last weeks. For a short period volumes suggest small correction. Stock market rise and possible QE actions will result fierce upward price changes. Silver's long period re-test of resistances has been broken, it's general and artificial undervaluation and accumulated underlying volumes hide behind, also general market conditions can result extreme bullish price changes, much larger than gold's rise.

No comments:

Post a Comment