A very quick overview about my decisions.

First of all, sorry for my short updates. I got a new role in my career, need to lead a team and became absolutely overloaded.

For the end of the day I am very tired, and have no power to write a post, and I need to leave early.

Anyway, let's have some insights.

We went through on the session of basics of volume based TA, and now it's time to demonstrate some tricky things, also show a safe and working strategy making profit on precious metals.

For now I have 6 units of HUI and 1 unit of SPX. I hope I don't need to explain my opinion about stockmarket.

Starting at dollar:

It's clear USD almost finished it's bullish cycle and ready for a new bear cycle will push precious metals (PM) up and stocks as well. Main reason of my buy was this pathetic bull cycle. Guys, USD is before a huge drop, this bull was an extremely weak one.

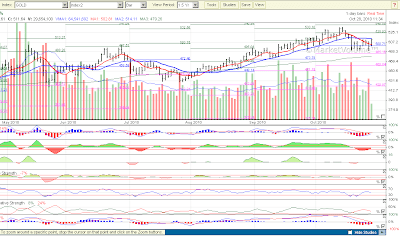

HUI

1-day chart clearly shows an exhausting bear. This bear cycle was very weak signaling the power of the main bull trend.

2-days HUI histo and oscillator shows bear exhaustion as well. We need to monitor the buy volume. Rising momentum gives hope for a rise. With strong monitoring ur 6 units of HUI will make nice money.

If HUI falls dramatically, we will give up some of our old positions, but I rather count with bull continuation and rise.

market:

1-day RUA chart shows strengthening internals, however we have a risk of a bigger correction.

I bought the 1 unit of SPX because of the robust bull momentum usually signals bull price manifestation.

1 day RUA fakeout analysis gives clear indication of fake bear.

classic analysis:

NYMO:

According to NYMO average cross market is not safe

Falling MA on MA50 is a clear singal of correction. However, according to the volume analysis, it can happen very quickly.

Smarts are pathetic, FED protects market against major fall. Please also note MA50/200 X on SPX gives bull signal for traders.

With strong monitoring, ichimoku analysis we can protect our gains and we have a good chance to make some profit.

I've read a question whether I amde my decision based on my emotions.

My answer is >>>NO<<<. It was no emotional.

I have my opinion about the market and US economy. But market has decoupled from foundations long time ago. We need to trace volumes and trade accordingly.

Good luck!

Thursday, October 28, 2010

Wednesday, October 27, 2010

Tuesday, October 26, 2010

1 unit of HUI and SPX bought

HUI@ 505

SPX@1182

Why?

Simple: Dollar 'bull' is over, SPX bear cycles have no power, HUI 'bear' cycle seems eliminating and we made sooo much money, so I take a small risk in hope of nice gain.

Market might play squiggles, we just close our eyes for a few days.

I'll make charts tomorrow. Meanwhile please open your own MV and check histo and oscillator.

I already gave 1d and 60 min setups.

Cheers.

SPX@1182

Why?

Simple: Dollar 'bull' is over, SPX bear cycles have no power, HUI 'bear' cycle seems eliminating and we made sooo much money, so I take a small risk in hope of nice gain.

Market might play squiggles, we just close our eyes for a few days.

I'll make charts tomorrow. Meanwhile please open your own MV and check histo and oscillator.

I already gave 1d and 60 min setups.

Cheers.

Possible trade as of 26th OCT

Dear my Readers,

As you know, I try to signal my trades a day in advance.

If prices fall today, I might buy 1 unit of HUI.

Cheers

As you know, I try to signal my trades a day in advance.

If prices fall today, I might buy 1 unit of HUI.

Cheers

Monday, October 25, 2010

EOD summary

Another steamless day up.

Market internals are still not safe.

Let's start with financials.

Financials are being shorted for days. Price manifestation will come into effect when buy volume is zero.

Russel 2000:

Already started it's bearish cycle, bearish volume rose from steady zero, buy volume is declining.

R3K:

My favourite index is broken as well. Our invisible hands do everything in order to keep selling volume on steady zero. It needs only a small push and prices will fall.

R3K 60 min:

Current bull cycle finished. Now there is a bearish cycle starting.

Market is totally prepared for a drop.

I am showing you a chart with after-hours trade.

Please note the EOD sell spike.

Good luck!

Market internals are still not safe.

Let's start with financials.

Financials are being shorted for days. Price manifestation will come into effect when buy volume is zero.

Russel 2000:

Already started it's bearish cycle, bearish volume rose from steady zero, buy volume is declining.

R3K:

My favourite index is broken as well. Our invisible hands do everything in order to keep selling volume on steady zero. It needs only a small push and prices will fall.

R3K 60 min:

Current bull cycle finished. Now there is a bearish cycle starting.

Market is totally prepared for a drop.

I am showing you a chart with after-hours trade.

Please note the EOD sell spike.

Good luck!

Thursday, October 21, 2010

After bell status

Today we had a pathetic day and, in spite of a green day internals now broken.

As you can see, both short and long period histo in negative territory (actually short histo lost 10%), oscillator lost 14 % and momentum lost 0.1 in a day. Also buy volume signals 26% now, lost 14 points, sentiment is on critical 46. Internals are broken and not safe.

However, smarts might play a game tomorrow and push prices higher attracting others to make room loading some cheap puts and finally drop market down the day after.

I will be away, all the day tomorrow I am travelling but I declare now: I will not buy, market is not safe.

I know I might disappoint you, from now I wait for days or weeks for the safe entry.

Predators do the same. Sit, observe and try to catch the right moment.

Be a predator, not a victim.

Good luck!

As you can see, both short and long period histo in negative territory (actually short histo lost 10%), oscillator lost 14 % and momentum lost 0.1 in a day. Also buy volume signals 26% now, lost 14 points, sentiment is on critical 46. Internals are broken and not safe.

However, smarts might play a game tomorrow and push prices higher attracting others to make room loading some cheap puts and finally drop market down the day after.

I will be away, all the day tomorrow I am travelling but I declare now: I will not buy, market is not safe.

I know I might disappoint you, from now I wait for days or weeks for the safe entry.

Predators do the same. Sit, observe and try to catch the right moment.

Be a predator, not a victim.

Good luck!

Today's word

Is patience.

We made almost 40%, nothing to hurry. Here in this blog we risk as less as possible and market internals are far from being safe.

There is an upcoming bearish wave estimated to arrive in 3-4 hours (if single), let's see it's strength.

Good luck!

We made almost 40%, nothing to hurry. Here in this blog we risk as less as possible and market internals are far from being safe.

There is an upcoming bearish wave estimated to arrive in 3-4 hours (if single), let's see it's strength.

Good luck!

Wednesday, October 20, 2010

Quick update

Dear my Readers,

First of all, many thanks for your compliments.

There are much, much better guys than me, but they remain silent and make money for smarts.

I will introduce you a masterwork in few days where you can see all wisdom about volumes in one place.

However I am in constant rush, so let me summarize our situation:

I hope that you already have an MV account, at least a 30 days trial. It's free. Believe me it gives so much help to understand stock market and main commodities.

1-day RUA:

Yesterday I sold my 1 unit of SPX as sell volume rose from steady zero.

There was some 40 mins left till closing bell, and a bull surge corrected it for zero again.

Anyway in my earlier post I told to check this every 2-3 hours intraday, and if it rises on 1-day, market is not safe, even it corrects to zero.

As you can see, MVO is declining, and momentum is bearish, both histo remain negative so I dont buy this 'rally'.

RUA 60 min:

Now it's clear that today is a gap buyup, and market could not manage to produce more than a middle gap-close.

While all the gap is not closed and long and short histo and momentum gives bearish signal on 1-day, market is not safe.

I dont have time to show you dollar, hui, etc, need to run.

Thanks again for your all nice words!

cheers: salad

First of all, many thanks for your compliments.

There are much, much better guys than me, but they remain silent and make money for smarts.

I will introduce you a masterwork in few days where you can see all wisdom about volumes in one place.

However I am in constant rush, so let me summarize our situation:

I hope that you already have an MV account, at least a 30 days trial. It's free. Believe me it gives so much help to understand stock market and main commodities.

1-day RUA:

Yesterday I sold my 1 unit of SPX as sell volume rose from steady zero.

There was some 40 mins left till closing bell, and a bull surge corrected it for zero again.

Anyway in my earlier post I told to check this every 2-3 hours intraday, and if it rises on 1-day, market is not safe, even it corrects to zero.

As you can see, MVO is declining, and momentum is bearish, both histo remain negative so I dont buy this 'rally'.

RUA 60 min:

Now it's clear that today is a gap buyup, and market could not manage to produce more than a middle gap-close.

While all the gap is not closed and long and short histo and momentum gives bearish signal on 1-day, market is not safe.

I dont have time to show you dollar, hui, etc, need to run.

Thanks again for your all nice words!

cheers: salad

Tuesday, October 19, 2010

SOLD 1 unit of SPX @1168

Our compound return is 38,16% now. Cool.

Please find details in trades section. ( http://smartmoneyvolume.blogspot.com/p/trades.html )

As you could see, with some experience we could make some 13 spx points more, but here we simulate a less experienced trader. I feel it's still a nice money.

We had to wait so long time. But now, we have a clear and nice bearish setup as:

-On 1-day RUA selling volume rose from steady zero.

-Histo gives negative signal.

-Momentum fell under 1

-Long histo gives negative signal as well.

We have nothing to do just wait and perform bear fakeout checks on daily basis and enjoy some 60 min analysis to check whether bear side is exhausting.

Please find details in trades section. ( http://smartmoneyvolume.blogspot.com/p/trades.html )

As you could see, with some experience we could make some 13 spx points more, but here we simulate a less experienced trader. I feel it's still a nice money.

We had to wait so long time. But now, we have a clear and nice bearish setup as:

-On 1-day RUA selling volume rose from steady zero.

-Histo gives negative signal.

-Momentum fell under 1

-Long histo gives negative signal as well.

We have nothing to do just wait and perform bear fakeout checks on daily basis and enjoy some 60 min analysis to check whether bear side is exhausting.

Confirmation

Dear my Readers,

I confirm that I BOUGHT 1 unit of HUI.

We are in phase 3.Please read my corresponding post: http://smartmoneyvolume.blogspot.com/2010/10/about-silver-i.html

as you can see in that post, I plan to buy 3 HUI units in this gold correction.

I know it's early and HUI might correct more. I am cost averaging.

Gold has a different behavior, everything happens much faster than stock market.

PMs correct less than market, and gap up heavily.

Now I count with daily squiggles for 8-10 days in both sectors then a further dip.

When others buy I sell, (please find my last HUI sell) and when others sell, I buy.

Otherwise we dont make profit.

James, many thanks for you kind help.

I am so happy to have a small team help each-other.

I confirm that I BOUGHT 1 unit of HUI.

We are in phase 3.Please read my corresponding post: http://smartmoneyvolume.blogspot.com/2010/10/about-silver-i.html

as you can see in that post, I plan to buy 3 HUI units in this gold correction.

I know it's early and HUI might correct more. I am cost averaging.

Gold has a different behavior, everything happens much faster than stock market.

PMs correct less than market, and gap up heavily.

Now I count with daily squiggles for 8-10 days in both sectors then a further dip.

When others buy I sell, (please find my last HUI sell) and when others sell, I buy.

Otherwise we dont make profit.

James, many thanks for you kind help.

I am so happy to have a small team help each-other.

Monday, October 18, 2010

EOD

Our invisible hands did a joke, made a double on 60-min fooling all the bears:

RUA 60 min

Bear cycle has been postponed for tomorrow. Every day is a survival.

This is an asymmetric bull. I am really curious about the continuation.

However, bulls made money today and we made nice points on this blog.

RUA 1-day:

Bull on 1-day RUA remain intact.

So we keep our 1 unit of SPX and watch the show tomorrow.

In turn, USD has a strong bull setup upside, but strong hands short it.

This is the price. Inflation is our friend.

RUA 60 min

Bear cycle has been postponed for tomorrow. Every day is a survival.

This is an asymmetric bull. I am really curious about the continuation.

However, bulls made money today and we made nice points on this blog.

RUA 1-day:

Bull on 1-day RUA remain intact.

So we keep our 1 unit of SPX and watch the show tomorrow.

In turn, USD has a strong bull setup upside, but strong hands short it.

This is the price. Inflation is our friend.

Week-end summary

We had a very exciting week, and I am more than happy to show you a market correction with all the small steps internals slowly changing and manifest to price effects.

Let's see where are we now:

RUA 1-day:

RUA 1-day seems fine so far, internals are pretty strong. What gives some doubt is a contrarian behavior of momentum VS internals. Histo made some gain, oscillator is on 60% (strong), buying power is strong as well, MVO is giving stronger and stronger signals, long-term histo gives positive signal again, but momentum is dramatically down. Friday was a big volume surge, finally became a green day, but in spite of nice bullish volume rises price did not rise and market lost momentum. It's a contrary behavior. A green day with this so much bull volume should result immediate price effect (1-1,5% rise at least). I feel it's a clear signal of struggling market, broken internals.

Usually this kind of bull rally without major price effect results a day down next day: smarts push prices up, and pass their calls on a good price, while market internals slowly break.

I did not sell my 1 unit of spx as internals are still give a chance to recover (bearish volume signal is steady zero).

RUA 60 min:

There was a huge bearish volume attack started EOD 14th of October. This level of histo did not occur in the last 1,5 years. It seems me institutions are in a big fight . They sell and some other immediately buys it, almost parallel. However, MV green/red singal swithc suggests trend change, also sentiment could not recover; in spite of the last bull surge both of them signal bearish continuation. Chance is high for a negative price manifestation.

SPS (RIFIN) 2-days:

As you know, I always check financials as my daily routine. I recommend you the same.

We have typical, broken internals with price manifestation on 2-days chart suggest immediate liquidation of longs.

This setup is a textbook sample of bearish trend-change setup.

Let's see the symptoms one by one:

-Huge sell volume spike on volumes (4,38B when 14 bar (28 day) MVA is 2,93!!!!)

-Bull histo cycle without any price effect

-Oscillator shows failed bull cycle as well

-Steady bull volume, but rising sell volume resulting this high price change suggest further continuation

-MVO exhausted

-Momentum fell from 1.91 to 0.67 -clear bearish signal

-Sentiment is still fine, however in downturn.

It's almost safe to short financials. As I told there is no growth without healthy financials. And financials can drag market down. Whatever news will come in the earnings season, prices will just fall and fall.

Please note that we don't short in this blog. We try to avoid any kind of major loss and ride the bull side only.

SPS RIFIN 1 day:

Absolutely broken internals. Bull cycle is over, oscillator shows upcoming bear, rising bearish volume will drag steady buy volume down . Please observe: volumes afloat, both of them levitate above signal line can cause fierce price change. Bull an bear safe while one of them is steady zero while other is rising. Now both up, so bears and bulls perform huge fight. As I told, we can see a huge institutional fight: some institution immediately buys selling volume and tries to block, or at least mitigate price effect. Financials almost always manipulated, so it's not a problem, but this level of manipulation is almost a fun to watch.

RIFIN 60 min:

Beautiful. We can read all of the fight from the chart above. As you can see, volume surges were that strong MV gave a green-red-green signal. However, I would be really surprised if there would not be bearish continuatuion. Why? That 4Bn bar on 2-days broke dramatically internals.

So, firts half of the week will be really exciting. We just need to sit back and enjoy the show of this heavy- weight fight. Why am I telling that it's an institutional fight? Smarts against smalls would not be in sync this so perfect. Some institution tracks internals and protect market against a major fall: buy immediately.

Also I would like to tell something: it's so funny to read news. Foreclosures in progress almost 1,5 years, make everyday tragedy for families, and media just picks up this topic. NOW.

Come on... All of this hype is designed and planned well. IMO. Anyway it's just my conspiracy theory.... haha...

SOX 1-day

My beloved SOX is broken since 6th of october. Since then I am out and wait for some clear signal.

Please observe again the contrary behavior: Price is up while histo and oscillator lose steam, also momentum has lost power. Here smarts play with smalls. I am out, so only observe this play.

XOM 1-day:

As I told once, oil and energy industry is not my specialisation, but, heck, it's matured for a correction:

Histo is flat for days, oscillator is below critical level, momentum is converging to zero. What is more important, sentiment trend is clear down.

I feel once sell volume rises from zero, it's a true money making machine to short XOM.

I see we have an oil-trader between us, therefore I ask him to share his opinion about energy sector. Thanks!

GOLD miners HUI 1-day:

As I told in my last post, HUI was ready for a correction and that correction started.

A loss of 1.44% was not enough to rise bearish volume from steady zero. I definitely would NOT short gold and gold miners. These corrections are good, to add more.

We have negative histo reading, critical oscillator level negative momentum RSI, and negative long period histo. Please also observe gold (GLD) had a second bear volume spike on Friday.

I'll wait a little and gradually give 3 more HUI units in the next 2 weeks. In my following silver post I'll tell you why.

GOLD/Silver miners (XAU)

As per moment XAU is strong and long. We need to check: it's almost sure that silver will perform a correction if both market and gold correct.

USD 1-day

Finally US Dollar. Since august I keep saying dollar is in focus:

There are enormous hands don't want dollar to rise. However, it will.

I already noted the huge bull volume signal last friday, but let's see the details:

Both short and long period histo gives positive readings, oscillator is above critical level, internals are really weak for a bearish dollar continuation.

However, some invisible hand does not want dollar to rise: there is a bearish surge on MVO from last Friday.

Bearish momentum is fading as well.

Nice setup for a bull switch.

Classic measures:

NYMO:

Nymo signals hesitating market, slowly a megaphone pattern is preparing. We need time to have more information.

SPXA50:

I just hardly can imagine any growth from this level. Maybe market can rise a little, but we are on extreme highs.

Summary:

Since last Wednesdays bullish internals breaking. Financials already in bearish spiral can drag market down.

Most fragile sectors are financials and energy.

However longer term internals (1-2 days) are very strong, so as per moment no action to be taken according to our strategy. I keep our 1 unit of SPX. If market goes down without hurting our 1-day internals, I'll buy a 2nd unit of SPX. If internals break, or we reach the soft liquidation I will take profit and sell our 1 SPX unit.

There can always be an unexpected news or natural disaster, therefore it's time to re-draw our ichimoku chart, draw some imagination about the upcoming days and set up cloud support, soft liquidation and hard liquidation levels.

My bias is bearish and I count with fierce price manifeastation. We have a strong ichimoku support at 1150 that will be the primary taget of the market. However, second bearish wave will attempt to test the gap between 1135 and 1140. If market falls under 1135, then hard liquidation must be performed and we will wait for clear bull signals.

Good luck!

Let's see where are we now:

RUA 1-day:

RUA 1-day seems fine so far, internals are pretty strong. What gives some doubt is a contrarian behavior of momentum VS internals. Histo made some gain, oscillator is on 60% (strong), buying power is strong as well, MVO is giving stronger and stronger signals, long-term histo gives positive signal again, but momentum is dramatically down. Friday was a big volume surge, finally became a green day, but in spite of nice bullish volume rises price did not rise and market lost momentum. It's a contrary behavior. A green day with this so much bull volume should result immediate price effect (1-1,5% rise at least). I feel it's a clear signal of struggling market, broken internals.

Usually this kind of bull rally without major price effect results a day down next day: smarts push prices up, and pass their calls on a good price, while market internals slowly break.

I did not sell my 1 unit of spx as internals are still give a chance to recover (bearish volume signal is steady zero).

RUA 60 min:

There was a huge bearish volume attack started EOD 14th of October. This level of histo did not occur in the last 1,5 years. It seems me institutions are in a big fight . They sell and some other immediately buys it, almost parallel. However, MV green/red singal swithc suggests trend change, also sentiment could not recover; in spite of the last bull surge both of them signal bearish continuation. Chance is high for a negative price manifestation.

SPS (RIFIN) 2-days:

As you know, I always check financials as my daily routine. I recommend you the same.

We have typical, broken internals with price manifestation on 2-days chart suggest immediate liquidation of longs.

This setup is a textbook sample of bearish trend-change setup.

Let's see the symptoms one by one:

-Huge sell volume spike on volumes (4,38B when 14 bar (28 day) MVA is 2,93!!!!)

-Bull histo cycle without any price effect

-Oscillator shows failed bull cycle as well

-Steady bull volume, but rising sell volume resulting this high price change suggest further continuation

-MVO exhausted

-Momentum fell from 1.91 to 0.67 -clear bearish signal

-Sentiment is still fine, however in downturn.

It's almost safe to short financials. As I told there is no growth without healthy financials. And financials can drag market down. Whatever news will come in the earnings season, prices will just fall and fall.

Please note that we don't short in this blog. We try to avoid any kind of major loss and ride the bull side only.

SPS RIFIN 1 day:

Absolutely broken internals. Bull cycle is over, oscillator shows upcoming bear, rising bearish volume will drag steady buy volume down . Please observe: volumes afloat, both of them levitate above signal line can cause fierce price change. Bull an bear safe while one of them is steady zero while other is rising. Now both up, so bears and bulls perform huge fight. As I told, we can see a huge institutional fight: some institution immediately buys selling volume and tries to block, or at least mitigate price effect. Financials almost always manipulated, so it's not a problem, but this level of manipulation is almost a fun to watch.

RIFIN 60 min:

Beautiful. We can read all of the fight from the chart above. As you can see, volume surges were that strong MV gave a green-red-green signal. However, I would be really surprised if there would not be bearish continuatuion. Why? That 4Bn bar on 2-days broke dramatically internals.

So, firts half of the week will be really exciting. We just need to sit back and enjoy the show of this heavy- weight fight. Why am I telling that it's an institutional fight? Smarts against smalls would not be in sync this so perfect. Some institution tracks internals and protect market against a major fall: buy immediately.

Also I would like to tell something: it's so funny to read news. Foreclosures in progress almost 1,5 years, make everyday tragedy for families, and media just picks up this topic. NOW.

Come on... All of this hype is designed and planned well. IMO. Anyway it's just my conspiracy theory.... haha...

SOX 1-day

My beloved SOX is broken since 6th of october. Since then I am out and wait for some clear signal.

Please observe again the contrary behavior: Price is up while histo and oscillator lose steam, also momentum has lost power. Here smarts play with smalls. I am out, so only observe this play.

XOM 1-day:

As I told once, oil and energy industry is not my specialisation, but, heck, it's matured for a correction:

Histo is flat for days, oscillator is below critical level, momentum is converging to zero. What is more important, sentiment trend is clear down.

I feel once sell volume rises from zero, it's a true money making machine to short XOM.

I see we have an oil-trader between us, therefore I ask him to share his opinion about energy sector. Thanks!

GOLD miners HUI 1-day:

As I told in my last post, HUI was ready for a correction and that correction started.

A loss of 1.44% was not enough to rise bearish volume from steady zero. I definitely would NOT short gold and gold miners. These corrections are good, to add more.

We have negative histo reading, critical oscillator level negative momentum RSI, and negative long period histo. Please also observe gold (GLD) had a second bear volume spike on Friday.

I'll wait a little and gradually give 3 more HUI units in the next 2 weeks. In my following silver post I'll tell you why.

GOLD/Silver miners (XAU)

As per moment XAU is strong and long. We need to check: it's almost sure that silver will perform a correction if both market and gold correct.

USD 1-day

Finally US Dollar. Since august I keep saying dollar is in focus:

There are enormous hands don't want dollar to rise. However, it will.

I already noted the huge bull volume signal last friday, but let's see the details:

Both short and long period histo gives positive readings, oscillator is above critical level, internals are really weak for a bearish dollar continuation.

However, some invisible hand does not want dollar to rise: there is a bearish surge on MVO from last Friday.

Bearish momentum is fading as well.

Nice setup for a bull switch.

Classic measures:

NYMO:

Nymo signals hesitating market, slowly a megaphone pattern is preparing. We need time to have more information.

SPXA50:

I just hardly can imagine any growth from this level. Maybe market can rise a little, but we are on extreme highs.

Summary:

Since last Wednesdays bullish internals breaking. Financials already in bearish spiral can drag market down.

Most fragile sectors are financials and energy.

However longer term internals (1-2 days) are very strong, so as per moment no action to be taken according to our strategy. I keep our 1 unit of SPX. If market goes down without hurting our 1-day internals, I'll buy a 2nd unit of SPX. If internals break, or we reach the soft liquidation I will take profit and sell our 1 SPX unit.

There can always be an unexpected news or natural disaster, therefore it's time to re-draw our ichimoku chart, draw some imagination about the upcoming days and set up cloud support, soft liquidation and hard liquidation levels.

My bias is bearish and I count with fierce price manifeastation. We have a strong ichimoku support at 1150 that will be the primary taget of the market. However, second bearish wave will attempt to test the gap between 1135 and 1140. If market falls under 1135, then hard liquidation must be performed and we will wait for clear bull signals.

Good luck!

Friday, October 15, 2010

RUA 30 min

That huge bearish volume is being eliminated.

We can state, it had a weak price effect

Let's see whether it will be a double. We need time to measure the upcoming short-term bull.

(I bet it will be a double drags prices down EOD)

Please open your account:

RUA 30 mins:

Histo: 20, 40

Osc: 16,4

We can state, it had a weak price effect

Let's see whether it will be a double. We need time to measure the upcoming short-term bull.

(I bet it will be a double drags prices down EOD)

Please open your account:

RUA 30 mins:

Histo: 20, 40

Osc: 16,4

Here we go

Smarts sniffed out the upcoming USD bull.

Please open your MV account

Please observe that 7.53M buy spike today. (14 day vma is 3.8M) !!!

USD 1 day:

Histo 5,13

Osc 5,2

USD 60 min:

Histo 8,16

Osc: 6,2

Good luck!

Please open your MV account

Please observe that 7.53M buy spike today. (14 day vma is 3.8M) !!!

USD 1 day:

Histo 5,13

Osc 5,2

USD 60 min:

Histo 8,16

Osc: 6,2

Good luck!

Quick before-the-bell post

Dear Readers,

So, everything goes as expected so far. The bearish cycle begun tuesday manifested yesterday.

I'll make a quick general market status summary with a few sentence of commentary.

New readers please read posts since last Friday. Thanks.

USD:

As I told recently, USD is in focus now. It has reached the inherited ichimoku support yesterday.

This level should be defended, and at least tried to be put toward 80s. As USD started to be an inverse mirror of SPX, I expect market consolidation, also correction in gold prices.

I will adjust chart above, things happen a little faster I thought, trend is important.

Marketvolume implemented USD today. It's great! They made a small trick: since this index does not have volume, they calculate volume of US Dollar Bullish and Bearish powershares.

Now, as we have USD, GOLD and RUA/SPX on marketvolume we can make holistic analysis about market and gold as well! If you are interested in further details, please follow this link: http://marketvolume.com/content/messages/archive/2010_10_08_gld.asp .

Let's see marketvolume chart of USD:

We can see typical bullish pre-signals on 1-day:

-Histo gives positive measure since yesterday

-SBV oscillator above critical level, signals possible elimination of bearish volume

-Long-preriod histo is positive as well

In order to have more bullish signal, zero level buying volume needs to rise from zero, also momentum needs to converge to zero from negative readings.

In summary: We have high possibility of dollar trend-change. Possible resistance is 77.5.

Market:

RUA 1-day:

Internals remain intact on 1-day chart.

-Histogram is in positive territory and made some gain yesterday

-Oscillator is still strong producing 3% gain yesterday

-MVO started to signal a local surge

-Market lost momentum, but still in strong positive territory

-Sentiment is steady 59

All readings are bullish, except momentum, what is a leading indicator of change.

RUA 60-min:

We had a very strong bearish attach. Oscillator gave extreme signal (-86). Market is nervous.

It can indicate a start of a trend-change on 1-day chart.

MVO gave a bearish trend-change signal, momentum went to negative afternoon.

Sentiment is below 50 what is a clear signal of short-term trend change.

Longer period oscillator (fakeout oscilator) is on 1% signaling sell signal.

Summary: .

I'd be really surprised if first hours were not red, then I count with some easing and some sell last hours.

We need to check how strong effect will that huge bearish power produce, that can generate trend-change.

Also bullish internals on USD suggest a breakout and price manifestation will generate some rise.

Please note: market trend change is a pretty slow process as you can see. We could see that change since it's beginning, and now it will be the 3rd day of it. As bearish volume is still steady 0 on RUA, I am not selling my 1 unit of SPX.

GOLD:

Gold miners matured for a bearish price manifestation.

-Histo gives negative numbers since 13th of october, indicator decreases every day.

-Oscillator lost 6% in 2 days, now it has 3% left from critical level

-MVO had a 3 day sequence of 1-2-1 reading, usually shows last thrust

-Momentum oscullator gives negative reading (-4), lost 11% in a day

-Sentiment lost 11%

-Long period histo gives slight negative readings

However selling volume is still steady zero.

After a long rally gold had it's matured for a correction. We reach phase 3 soon (please read my corresponding post)

http://smartmoneyvolume.blogspot.com/2010/10/about-silver-i.html

Good luck !

So, everything goes as expected so far. The bearish cycle begun tuesday manifested yesterday.

I'll make a quick general market status summary with a few sentence of commentary.

New readers please read posts since last Friday. Thanks.

USD:

As I told recently, USD is in focus now. It has reached the inherited ichimoku support yesterday.

This level should be defended, and at least tried to be put toward 80s. As USD started to be an inverse mirror of SPX, I expect market consolidation, also correction in gold prices.

I will adjust chart above, things happen a little faster I thought, trend is important.

Marketvolume implemented USD today. It's great! They made a small trick: since this index does not have volume, they calculate volume of US Dollar Bullish and Bearish powershares.

Now, as we have USD, GOLD and RUA/SPX on marketvolume we can make holistic analysis about market and gold as well! If you are interested in further details, please follow this link: http://marketvolume.com/content/messages/archive/2010_10_08_gld.asp .

Let's see marketvolume chart of USD:

We can see typical bullish pre-signals on 1-day:

-Histo gives positive measure since yesterday

-SBV oscillator above critical level, signals possible elimination of bearish volume

-Long-preriod histo is positive as well

In order to have more bullish signal, zero level buying volume needs to rise from zero, also momentum needs to converge to zero from negative readings.

In summary: We have high possibility of dollar trend-change. Possible resistance is 77.5.

Market:

RUA 1-day:

Internals remain intact on 1-day chart.

-Histogram is in positive territory and made some gain yesterday

-Oscillator is still strong producing 3% gain yesterday

-MVO started to signal a local surge

-Market lost momentum, but still in strong positive territory

-Sentiment is steady 59

All readings are bullish, except momentum, what is a leading indicator of change.

RUA 60-min:

We had a very strong bearish attach. Oscillator gave extreme signal (-86). Market is nervous.

It can indicate a start of a trend-change on 1-day chart.

MVO gave a bearish trend-change signal, momentum went to negative afternoon.

Sentiment is below 50 what is a clear signal of short-term trend change.

Longer period oscillator (fakeout oscilator) is on 1% signaling sell signal.

Summary: .

I'd be really surprised if first hours were not red, then I count with some easing and some sell last hours.

We need to check how strong effect will that huge bearish power produce, that can generate trend-change.

Also bullish internals on USD suggest a breakout and price manifestation will generate some rise.

Please note: market trend change is a pretty slow process as you can see. We could see that change since it's beginning, and now it will be the 3rd day of it. As bearish volume is still steady 0 on RUA, I am not selling my 1 unit of SPX.

GOLD:

Gold miners matured for a bearish price manifestation.

-Histo gives negative numbers since 13th of october, indicator decreases every day.

-Oscillator lost 6% in 2 days, now it has 3% left from critical level

-MVO had a 3 day sequence of 1-2-1 reading, usually shows last thrust

-Momentum oscullator gives negative reading (-4), lost 11% in a day

-Sentiment lost 11%

-Long period histo gives slight negative readings

However selling volume is still steady zero.

After a long rally gold had it's matured for a correction. We reach phase 3 soon (please read my corresponding post)

http://smartmoneyvolume.blogspot.com/2010/10/about-silver-i.html

Good luck !

Thursday, October 14, 2010

Intraday update

After 1, 15, 30 min, now bearish signals clear on 60 min as well.

We have nothing to do, just sit back and enjoy the show.

Please remember, we dont go to daytrade in this blog, we are waiting for signals on 1-day then 2-days charts, and make decision based on thet.

So, 60 min charts only for learning how smarts play. Please remember all the things started yesterday, before the jobs report. News only found later and matched to facts.

I can't update you today. Sorry.

Please log in to marketvolume.com.

You get the histogram and oscillator.

RUA 60-min setup:

Histogram 8,16

Oscillator 6,2

What needs to be checked, how powerful will the upcoming bearish volume be, and it's effect on 1-day charts. If effect is minor, then we can count with a small upcoming bearish rally, if it's eligible to damage internals on 1-day chart, then a little bigger correction comes.

I'll come back EOD and analyse or

Good luck!

60-min RUA:

We have nothing to do, just sit back and enjoy the show.

Please remember, we dont go to daytrade in this blog, we are waiting for signals on 1-day then 2-days charts, and make decision based on thet.

So, 60 min charts only for learning how smarts play. Please remember all the things started yesterday, before the jobs report. News only found later and matched to facts.

I can't update you today. Sorry.

Please log in to marketvolume.com.

You get the histogram and oscillator.

RUA 60-min setup:

Histogram 8,16

Oscillator 6,2

What needs to be checked, how powerful will the upcoming bearish volume be, and it's effect on 1-day charts. If effect is minor, then we can count with a small upcoming bearish rally, if it's eligible to damage internals on 1-day chart, then a little bigger correction comes.

I'll come back EOD and analyse or

Good luck!

60-min RUA:

About silver - I.

I delay my writing about about silver every day, so I decided to nail down my thoughts in parts.

As gold rally is heating emotions and now in focus, there is less talk about silver. Personally I wrote some posts about silver and rose the attention of my readers about the upcoming breakout since august.

If you bought some silver miner or silver ETF in august, now you can see a nice sum on your account. As dollar collapses and masses buy more and more gold white metal prices just go up.

The main reason of my writing is to show you:

-Nature of silver and gold

-Take-off mode

-Possible potential of growth after ATH is beaten

-Exit strategies in Take-off mode

Nature of silver

Silver, the white sister of gold is a strange metal. It sometimes behave as a precious metal, sometimes switches to be an industrial metal. What I need to stress is PM sector, especially silver is highly manipulated and volatile. I will repeat it every time in all my silver posts.

Personally I follow silver and silver miners years ago. The most powerful growth in silver prices can be observed when both stock market and gold is in bull.

Let me show the following chart.

In the chart above we can follow when silver run together with gold, decouples from gold, behaves as an industrial metal. Also please observe it's inverse mirror to USD.

Silver is extremely volatile. In a few days it can loose 10-15% of it's value.

Please observe silver sometimes make long (half year) of consolidation before a breakout.

PM breakouts:

Prices of precious metals are mostly driven by psychology.

Two extreme emotions:

-What can I do with my dollar? It has less and less value, inflation is high, my money is not in safe. I buy precious metals

-What can I do with this piece of useless metal? I cant' eat it. I need cash to buy something anyway, so I sell.

Let's see what can silver do in case of ATH breakout.

I made a chart for you.

Let's zoom into the period of january, 1st 2007 - july, 30th 2008:

As you can see, we have 5 phases at silver (gold is similar) take-off mode:

Phase 1: Long consolidation, boring metal. (sometimes finishing with a small crash, part of manipulation)

Phase 2: Silver performs a bull rally

Phase 3: Silver makes a correction (correct strategy is keep core position and add more)

Phase 4: Take-off mode (question is how to exit)

Phase 5: Crash (sad story)

As per moment silver (and gold) is somewhere in phase 2. I expect the same for silver now.

We almost have the same timing as well, and similar market circumstances and dollar fall as well.

Please observe the magnitude of corrections and crashes.

So it's easy to jump into the PM sector, but you need to have strong nerves staying with your bull and keep the large picture in mind and not let manipulation to kick you out from your core position.

The hardest point is phase 4. That period gives unbelievable gains, and driven by human psychology. There is no economy, no fundamentals, nothing behind, only human behavior.

Human greed spirals prices up and up to the skies while there is a day of recognition: there is no buyer on the other side.

Then the crash is fierce and huge. Silver can lose 25-30% in a few days.

The question is how to protect our gains, what is the exit strategy from PM sector?

We have several tools:

-Classic TA measures and indicators

-Classic Volume studies

-Computed, modern technologies

My next post will discuss that subject.

As gold rally is heating emotions and now in focus, there is less talk about silver. Personally I wrote some posts about silver and rose the attention of my readers about the upcoming breakout since august.

If you bought some silver miner or silver ETF in august, now you can see a nice sum on your account. As dollar collapses and masses buy more and more gold white metal prices just go up.

The main reason of my writing is to show you:

-Nature of silver and gold

-Take-off mode

-Possible potential of growth after ATH is beaten

-Exit strategies in Take-off mode

Nature of silver

Silver, the white sister of gold is a strange metal. It sometimes behave as a precious metal, sometimes switches to be an industrial metal. What I need to stress is PM sector, especially silver is highly manipulated and volatile. I will repeat it every time in all my silver posts.

Personally I follow silver and silver miners years ago. The most powerful growth in silver prices can be observed when both stock market and gold is in bull.

Let me show the following chart.

In the chart above we can follow when silver run together with gold, decouples from gold, behaves as an industrial metal. Also please observe it's inverse mirror to USD.

Silver is extremely volatile. In a few days it can loose 10-15% of it's value.

Please observe silver sometimes make long (half year) of consolidation before a breakout.

PM breakouts:

Prices of precious metals are mostly driven by psychology.

Two extreme emotions:

-What can I do with my dollar? It has less and less value, inflation is high, my money is not in safe. I buy precious metals

-What can I do with this piece of useless metal? I cant' eat it. I need cash to buy something anyway, so I sell.

Let's see what can silver do in case of ATH breakout.

I made a chart for you.

Let's zoom into the period of january, 1st 2007 - july, 30th 2008:

As you can see, we have 5 phases at silver (gold is similar) take-off mode:

Phase 1: Long consolidation, boring metal. (sometimes finishing with a small crash, part of manipulation)

Phase 2: Silver performs a bull rally

Phase 3: Silver makes a correction (correct strategy is keep core position and add more)

Phase 4: Take-off mode (question is how to exit)

Phase 5: Crash (sad story)

As per moment silver (and gold) is somewhere in phase 2. I expect the same for silver now.

We almost have the same timing as well, and similar market circumstances and dollar fall as well.

Please observe the magnitude of corrections and crashes.

So it's easy to jump into the PM sector, but you need to have strong nerves staying with your bull and keep the large picture in mind and not let manipulation to kick you out from your core position.

The hardest point is phase 4. That period gives unbelievable gains, and driven by human psychology. There is no economy, no fundamentals, nothing behind, only human behavior.

Human greed spirals prices up and up to the skies while there is a day of recognition: there is no buyer on the other side.

Then the crash is fierce and huge. Silver can lose 25-30% in a few days.

The question is how to protect our gains, what is the exit strategy from PM sector?

We have several tools:

-Classic TA measures and indicators

-Classic Volume studies

-Computed, modern technologies

My next post will discuss that subject.

Wednesday, October 13, 2010

After-hours data

Now 30-mins became confrimed bearish.

-Please observe 3 sell on strength sell spikes (sell on strength), especially the after-market collapse

-Histo almost eliminated

-Oscillator turned down

-Very strong MVO bear signal (please compare to 5th oct signal)

-Please observe 3 sell on strength sell spikes (sell on strength), especially the after-market collapse

-Histo almost eliminated

-Oscillator turned down

-Very strong MVO bear signal (please compare to 5th oct signal)

Trade - 1 HUI

sold@533 today, as I told before the opening bell.

Now our single (no margin used) compound is 26.3 %.

Please find details at Trades

Now our single (no margin used) compound is 26.3 %.

Please find details at Trades

Intraday update 4

Signals on 30 min RUA:

-Sequential sell on strength volume signals.

-Histo weakening, bearish cross soon (2-3 more bars needed)

-Oscillator is weakening

-MVO green/red switch -clear bearish singal, also strength is big

-Sequential sell on strength volume signals.

-Histo weakening, bearish cross soon (2-3 more bars needed)

-Oscillator is weakening

-MVO green/red switch -clear bearish singal, also strength is big

Intraday update 3

15-min RUA bear signals:

-Moving average bearish cross

-Histo bearish cross

-Oscillator at critical elvel

-Bearish volume cross

-Sell-on strengths selling volume spikes (well above 14 period volume moving average)

These are clear signals of breaking internals. It will go to the 30-min, 60 min and later to 1-day chart.

-Moving average bearish cross

-Histo bearish cross

-Oscillator at critical elvel

-Bearish volume cross

-Sell-on strengths selling volume spikes (well above 14 period volume moving average)

These are clear signals of breaking internals. It will go to the 30-min, 60 min and later to 1-day chart.

Intraday update 2

Next bear signal :

-14:49 Mclellan Vol osc turns to negative @1182.76 (top marked nicely!!)

-Failed bullish break at 15:17

-MVO bear signal within a bull breakout try

-15:18: red volume spike - sell on strength

Market talks. We only need to listen.

Daytraders started to load some shorts.

SPX 1-min

-14:49 Mclellan Vol osc turns to negative @1182.76 (top marked nicely!!)

-Failed bullish break at 15:17

-MVO bear signal within a bull breakout try

-15:18: red volume spike - sell on strength

Market talks. We only need to listen.

Daytraders started to load some shorts.

SPX 1-min

Intraday update

MVO shows surge top is over.

Smarts follow their usual scenario.

Now smalls cheer and buy while smarts could dump on a nice price.

It will turn out if it's a second half of asymmetric double bull or it has one more leg (chance for latter is pretty low)

Take a look into 60 mins RUA. Histo decreasing, oscillator topping MVO clearly signals finish.

Daytraders unload some longs for these signals and soon prepare to load some shorts.

Smarts follow their usual scenario.

Now smalls cheer and buy while smarts could dump on a nice price.

It will turn out if it's a second half of asymmetric double bull or it has one more leg (chance for latter is pretty low)

Take a look into 60 mins RUA. Histo decreasing, oscillator topping MVO clearly signals finish.

Daytraders unload some longs for these signals and soon prepare to load some shorts.

Good luck!

Before the bell of Opex wednesday

Dear My Readers,

Today will be a day up.

However, according to my experience, the purpose of this so nice day to dump longs, take profits, and start to prepare for the upcoming correction.

As I only have 1 unit of SPX and internals are pretty strong volume-wise, I will not sell my 1 unit of SPX till clear volume signal on 1-day MV chart.

Speculative approach:

Normally what smarts do, is a nice day up used to get rid of calls and load some cheap puts preparing for the upcoming correction. Then, next day is the day of price bearish price manifestation. That is a day when market internals break. After that day, usually a last dip buy comes pushing prices up, before trend-change.

I expect 60-80 points of drop in next 4-6 days, then some recovery and bullish continuation.

Gold miners:

As miners usually follow SPX correction and due for a short break, I will sell 1 unit of HUI today. I'll buy back that unit when miner market recovers (in 2-4 working days).

Good Luck!

Today will be a day up.

However, according to my experience, the purpose of this so nice day to dump longs, take profits, and start to prepare for the upcoming correction.

As I only have 1 unit of SPX and internals are pretty strong volume-wise, I will not sell my 1 unit of SPX till clear volume signal on 1-day MV chart.

Speculative approach:

Normally what smarts do, is a nice day up used to get rid of calls and load some cheap puts preparing for the upcoming correction. Then, next day is the day of price bearish price manifestation. That is a day when market internals break. After that day, usually a last dip buy comes pushing prices up, before trend-change.

I expect 60-80 points of drop in next 4-6 days, then some recovery and bullish continuation.

Gold miners:

As miners usually follow SPX correction and due for a short break, I will sell 1 unit of HUI today. I'll buy back that unit when miner market recovers (in 2-4 working days).

Good Luck!

Tuesday, October 12, 2010

Why read RUA if you trade e-minis?

While we are waiting for the FED's signals, (actually we already know the outcome, smarts just play a dip again) I decided to show you why do I prefer as large volume as possible.

This post is a gourmé piece of my posts I feel.

Let's see the chart I usually use for e-minis:

Yes, it's russel 3000 on 5 mins. You can see, histogram is jumping out of the screen, also SB volume shows a nice double bear characteristics giving a big probability for elimination, MVO gives us the favour to show bear/bull switch means trend change.

Perfect setup to trade bull on e-minis. Also, histo nicely showed an exit point !

Let's see the same on low-volume e-minis:

Histo is fine, but oscillator gives weak signal.

Double is not recognizable on volume indicator.

MVO and histo signals come much later.

So this is the reason I make a 3-day, 2-day, 1-day, 60 min, 15-min drill down before the bell, and then I only need to watch 60 mins 15 mins and 5 mins, sometimes take a look into 1 day.

It's all. Volumes talk. We only need to listen and make money.

Good luck!

Btw: What would you trade seeing current 5mins RUA just now?

Answer was here: http://smartmoneyvolume.blogspot.com/2010/10/prudent-day.html

This post is a gourmé piece of my posts I feel.

Let's see the chart I usually use for e-minis:

Yes, it's russel 3000 on 5 mins. You can see, histogram is jumping out of the screen, also SB volume shows a nice double bear characteristics giving a big probability for elimination, MVO gives us the favour to show bear/bull switch means trend change.

Perfect setup to trade bull on e-minis. Also, histo nicely showed an exit point !

Let's see the same on low-volume e-minis:

Histo is fine, but oscillator gives weak signal.

Double is not recognizable on volume indicator.

MVO and histo signals come much later.

So this is the reason I make a 3-day, 2-day, 1-day, 60 min, 15-min drill down before the bell, and then I only need to watch 60 mins 15 mins and 5 mins, sometimes take a look into 1 day.

It's all. Volumes talk. We only need to listen and make money.

Good luck!

Btw: What would you trade seeing current 5mins RUA just now?

Answer was here: http://smartmoneyvolume.blogspot.com/2010/10/prudent-day.html

Prudent day

As it was foreseeable, today started as a red day. It was a nice deal to play out this squiggle on e-minis.

Current bearish volume seems exhausting. It was not enough to drag market down.

Prabability is pretty high to this day to green I estimate market needs further 2 hours for current bearish elimination. A double bear on 60 min would drag market further down.

Nice moment for a quick daytrade dip-buy. Just a little, for shake of fun!

Good luck!

Current bearish volume seems exhausting. It was not enough to drag market down.

Prabability is pretty high to this day to green I estimate market needs further 2 hours for current bearish elimination. A double bear on 60 min would drag market further down.

Nice moment for a quick daytrade dip-buy. Just a little, for shake of fun!

Good luck!

Monday, October 11, 2010

Monday - recovery

RUA 2-days:

Now bullish volume recovered, however, I still miss the rise on momentum.

At least, while bullish volume is on this high level, big crash is hard to be made, so bulls can relax a bit.

MVO shows possible surge exhaustion. If market does not gain momentum, then we can expect a usual after-surge exhaust pullback. It's not more than 3-5%.

Rising sentiment is a good bull signal. Volume-based sentiment usually advances volume and price manifestation.

RUA 1-day:

We can see a big rise in buy volume. While buy volume rose, resulting bull turnback on histo, oscillator and SB volume indicator, momentum fell below 1. Below 1 is a bearish territory. It means a pathetic internal; volume upwards, momentum downwards, stagnating prices; chance is high : tomorrow is a red day. (however, I bet, Wednesday will be a bull)

GOLD:

Great news: marketvolume implemented GLD ETF. It's a low-volume ETF, but gives surprising clear signals.

Gold performs an unbelievable bullish rally, stronger and stronger and stronger every day.

Unfortunately this extreme bull will end in a crash loosing 6-9% of prior day's high. So how to exit?

I will write a post about silver. Silver is more volatile than gold and I will write some thoughts about possible exit strategies for smalls.

Everything is very bullish, on this chart, nothing to tell about it.

As you will see in my silver post, I give large change that we are long, long way from the end of this bull, at least 5 months ahead, and we will see surrealistic high numbers. It's a beginning of a hyperbolic rally.

HUI - Gold miners 1 day:

Now it seems it will be a double bull. First half of that was 20 days long and we are in the 10th day of the second half. So we can expect some correction in the next 7-10 days.

Good Luck!!

Now bullish volume recovered, however, I still miss the rise on momentum.

At least, while bullish volume is on this high level, big crash is hard to be made, so bulls can relax a bit.

MVO shows possible surge exhaustion. If market does not gain momentum, then we can expect a usual after-surge exhaust pullback. It's not more than 3-5%.

Rising sentiment is a good bull signal. Volume-based sentiment usually advances volume and price manifestation.

RUA 1-day:

We can see a big rise in buy volume. While buy volume rose, resulting bull turnback on histo, oscillator and SB volume indicator, momentum fell below 1. Below 1 is a bearish territory. It means a pathetic internal; volume upwards, momentum downwards, stagnating prices; chance is high : tomorrow is a red day. (however, I bet, Wednesday will be a bull)

GOLD:

Great news: marketvolume implemented GLD ETF. It's a low-volume ETF, but gives surprising clear signals.

Gold performs an unbelievable bullish rally, stronger and stronger and stronger every day.

Unfortunately this extreme bull will end in a crash loosing 6-9% of prior day's high. So how to exit?

I will write a post about silver. Silver is more volatile than gold and I will write some thoughts about possible exit strategies for smalls.

Everything is very bullish, on this chart, nothing to tell about it.

As you will see in my silver post, I give large change that we are long, long way from the end of this bull, at least 5 months ahead, and we will see surrealistic high numbers. It's a beginning of a hyperbolic rally.

HUI - Gold miners 1 day:

Now it seems it will be a double bull. First half of that was 20 days long and we are in the 10th day of the second half. So we can expect some correction in the next 7-10 days.

Good Luck!!

Subscribe to:

Posts (Atom)