A very quick overview about my decisions.

First of all, sorry for my short updates. I got a new role in my career, need to lead a team and became absolutely overloaded.

For the end of the day I am very tired, and have no power to write a post, and I need to leave early.

Anyway, let's have some insights.

We went through on the session of basics of volume based TA, and now it's time to demonstrate some tricky things, also show a safe and working strategy making profit on precious metals.

For now I have 6 units of HUI and 1 unit of SPX. I hope I don't need to explain my opinion about stockmarket.

Starting at dollar:

It's clear USD almost finished it's bullish cycle and ready for a new bear cycle will push precious metals (PM) up and stocks as well. Main reason of my buy was this pathetic bull cycle. Guys, USD is before a huge drop, this bull was an extremely weak one.

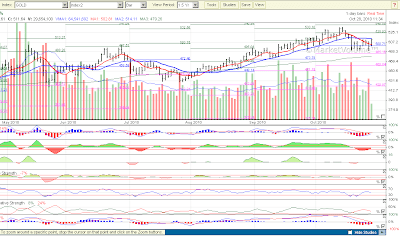

HUI

1-day chart clearly shows an exhausting bear. This bear cycle was very weak signaling the power of the main bull trend.

2-days HUI histo and oscillator shows bear exhaustion as well. We need to monitor the buy volume. Rising momentum gives hope for a rise. With strong monitoring ur 6 units of HUI will make nice money.

If HUI falls dramatically, we will give up some of our old positions, but I rather count with bull continuation and rise.

market:

1-day RUA chart shows strengthening internals, however we have a risk of a bigger correction.

I bought the 1 unit of SPX because of the robust bull momentum usually signals bull price manifestation.

1 day RUA fakeout analysis gives clear indication of fake bear.

classic analysis:

NYMO:

According to NYMO average cross market is not safe

Falling MA on MA50 is a clear singal of correction. However, according to the volume analysis, it can happen very quickly.

Smarts are pathetic, FED protects market against major fall. Please also note MA50/200 X on SPX gives bull signal for traders.

With strong monitoring, ichimoku analysis we can protect our gains and we have a good chance to make some profit.

I've read a question whether I amde my decision based on my emotions.

My answer is >>>NO<<<. It was no emotional.

I have my opinion about the market and US economy. But market has decoupled from foundations long time ago. We need to trace volumes and trade accordingly.

Good luck!

No comments:

Post a Comment