New week - new hopes!

Took a look into my statistics, and I have 527% growth this week.

Thanks for visiting my blog.

Status:

As a routine, let's check whether bull or bear scenario in play.

This is the 60-min forecast from last week-end: (http://smartmoneyvolume.blogspot.com/2010/09/week-end-summary.html):

and this is the status as per friday:

As we can see, bull trend was in play.

Also, HUI (gold) started it's decline as expected.

This week

O.k. so we could make a nice forecast with the help of classic TA + volume studies, but where will market go now?

In order to try to identify where market will go, we need to understand what happened in background. Most of tha major indexes targeted mid-aug highs last week and some of them, after completion started to attack 200-day MA. I'll show you some major indexes and their status, then we will make a final conclusion based on that.

OIL

Energy index has a confrimed market status with good momentum and failed bearish breakout results. As it just confirmed its bull, we can expect further bullish improvement.

Financials

As you know, there is no growth without improving financials. SPN (rifin) was in a bad shape say a week ago. It was heading down and just a small step was left to have clear technical liquidation - signal.

As you can see, it made a huge improvement and just confirmed a longer-term recovery.

Let's see it's internals:

It has a huge power behind, market internals show extreme local buying volume streaming into financials making sure it will not fall for a week or more.

Semiconductors:

Semiconductors index is my favourite one. It's relatively small, but perfect to be used for money making. Usually it leads market as a pre-indicator, now it's in lag compared to the other market-segments.

SOX volume studies:

Market internals of semiconductors show there was an enormous effort to turn back this index from clear bear to bull. Longer we observe what happened in the last 2 weeks with this index, deeper we understand the effort behind bulls made to save this segment (please check end-of august classic liquidation condition has been fulfilled). Smarts don't do like this, they wait for exhaustion and then bet contra. As I told, only few participants agreed to turn market back. This market, I must say has been saved by a benefactor. Now market internals are pretty strong, few days and it will give safe bull signal. As we see, it had a negative price manifestation made by smarts to enter. I already explained this effect, it rises lots of smart heads.

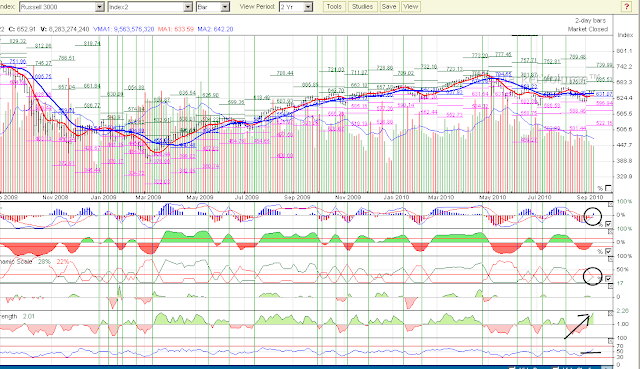

R3K

Both 1 day and 2 days chart indicate clear bull situation and strong oscillator levels suggest further bullish continuation.

SPX

IF RUA has bullish signals, then we can be sure, that will be valid for SPX as well. SPX confirms bull continuation in all classic and volume based TA as well.

Let's make a quick MA analysis. MA analysis is not respected by professionals too much, but I like to take a look sometimes. Please observe the similarity of current market status with 2006.

Finally let's see how NYMO is progressing:

We have a golden MA cross on NYMO means safe bull entry for smarts. Smarts will come and make money.

I am definitely bullish for this week. As you can see last week's pathetic days were used to fight on a huge front and save market. Most of the indexes confirmed bull return and went back to mid-aug levels, attacking 200MA. Newt fight is to take 200 MA and move higher.

Large indexes were artificially held back from price manifestation giving time everyone to join to the party. 1090 was constantly saved. When all the indexes confirm bull and buying volume will advance selling volume decrease, we will see a new jump, price manifestation will play, MA 200s will be taken, and market will fly.

I see this scenario as the most probable one. I dont amend last week's forecast, they are in play for this week.. I am not buying till 1126 is not taken.

This is an OPEX week. I expect bears will be forced to cover pushing market higher. Not all smarts agreed this time to turn market. Anything can happen bears might fight a little, this is their last chance to get rrid of their bets, so I keep our danger zone and soft-liquidation at 1060s.

GOLD:

Gold will cool down a little, I expect 6-8 days of cool-down. However, I will not play here by selling our units for 2 days and buy back. It's not worth. This time smarts make place for entry and they will pour a brutal amount of money in, making 3 or more percent growth in a day leaving masses out of the game. We should not try to be smarter than smarts. I simply will keep our 2 units of HUI and buy 1 more this week. If you lagh now, please read my beloved story about old turkey.

As we can see, 3 days chart shows weakening internals. However, upcoming bull rally on market resulting dollar debasement will push gold higher and higher.

Good luck!

No comments:

Post a Comment